28

2024/06

3 powerful price action strategies for effective trading

Nial Fuller, a staunch advocate of price action trading, is a well-known figure in this field. He consistently promotes the idea that simple charts can provide higher probabilities of trading success. In this article, we share Nial’s three favourite price action trading patterns: the Pin Bar, the Fakey, and the Inside Bar.

Nial believes that the Pin Bar, Fakeys, and Inside Bar trading patterns are incredibly simple yet powerful. With enough discipline and patience, these strategies can become highly effective “weapons” in your trading arsenal.

1. Pin Bar Strategy

The Pin Bar is Nial’s primary trading strategy and is a crucial pattern in price action trading, especially accurate in trending markets and key areas. Pin Bars often appear at significant support and resistance levels and can signal trend reversals. When a Pin Bar stands out among surrounding candlesticks, it usually indicates a trend reversal. The daily chart is the best timeframe for utilizing Pin Bars.

Below is a classic example of Pin Bar patterns: the first indicates an imminent downtrend, and the second signals an upcoming uptrend.

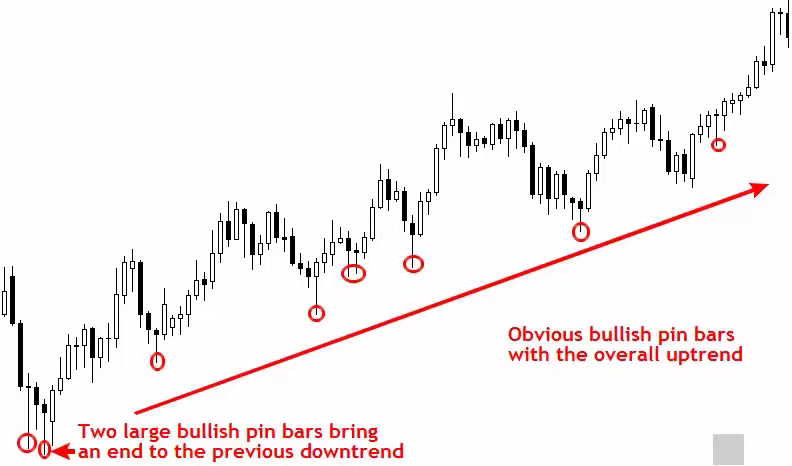

The following chart shows Pin Bars appearing in an uptrend, which is another favourite trading pattern of mine. Notice the two bullish Pin Bars at the bottom left, signalling the end of the prior downtrend and the start of an uptrend.

2. Fakey Strategy

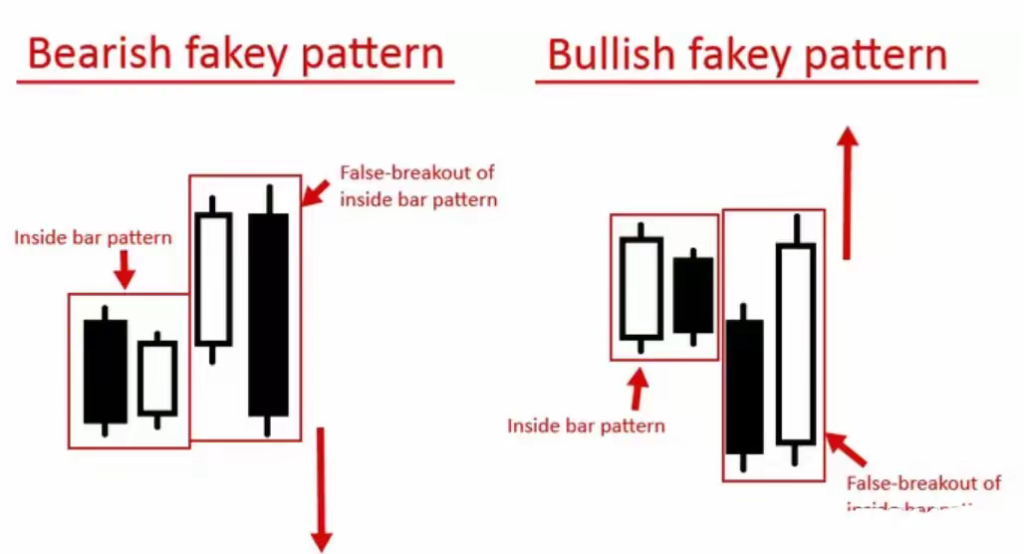

The Fakey trading strategy is an additional “bread and butter” pattern in price action trading. It usually accompanies an “inside bar” pattern, often leading to a “false breakout” and indicating a trend reversal.

Many novice traders might need to become more familiar with the Fakey pattern, which occurs primarily due to the actions of large traders such as banks and hedge funds. This pattern emerges in the following scenarios:

- Large traders deliberately absorb the positions of retail traders, forcing them to abandon their positions, then swiftly push the price in the opposite direction.

- The market overreacts to significant risk events, leading to a trend reversal.

Regardless of the situation, the Fakey pattern is a strong entry signal, indicating a potential movement in the opposite direction of the “false breakout.”

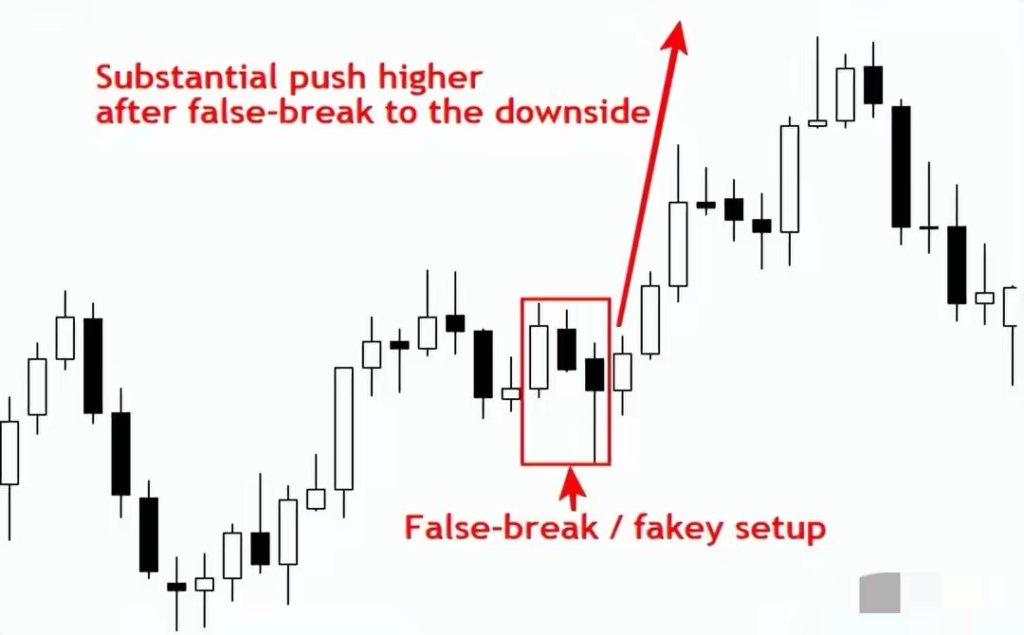

In the chart below, you can see the price forming a Fakey pattern after reaching a new high. Novice traders might impulsively short the market upon seeing this pattern. In contrast, professional traders wait for these retail traders to fall into the trap, then capitalize on their mistakes. As the saying goes, “One wrong move can lead to a total defeat!”

3. Inside Bar Strategy

The Inside Bar is an excellent signal for both trend continuation and trend reversal. Here’s how the Inside Bar works as a trend continuation signal.

An Inside Bar consists of a preceding “Mother Bar” and a subsequent “Inside Bar.” The Inside Bar is almost entirely contained within the Mother Bar, with its high and low prices not exceeding those of the Mother Bar. Although the ideal shape might not always appear in fundamental markets, variations can occur.

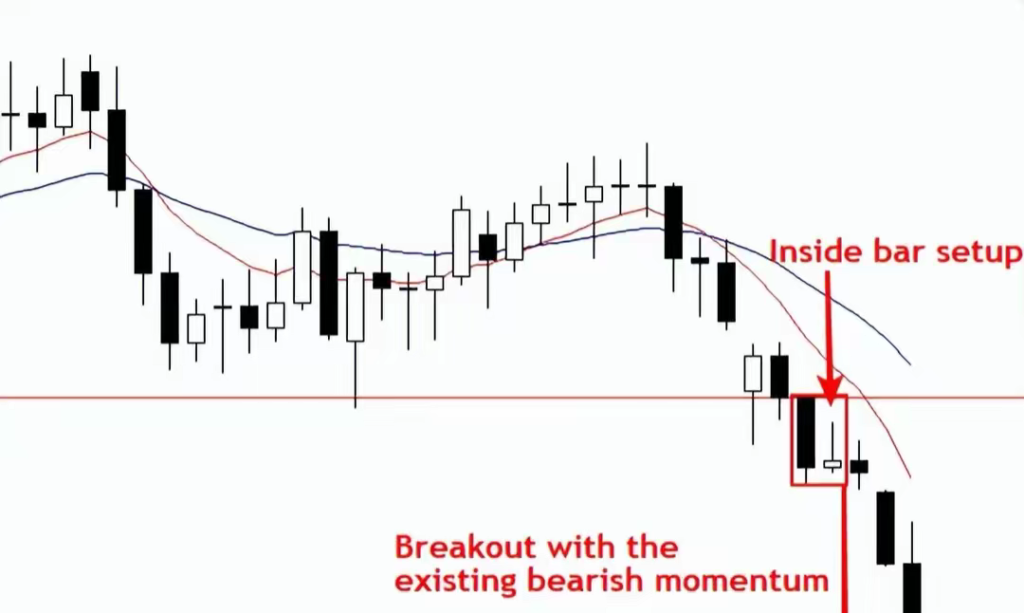

In the chart below, the candlestick on the right is entirely contained within the previous day’s candlestick, indicating that the price is likely to continue in the direction of the main trend after a brief consolidation. Notably, daily and weekly charts are the best timeframes for utilizing Inside Bars, allowing you to capture more significant profits with lower risk.

You can trade the Inside Bar pattern regardless of whether it appears upwards or downwards. Once confirmed, draw a horizontal line at the Mother Bar. If the pattern appears in a downtrend, as shown in the EUR/USD chart below, draw the line above the Mother Bar. Once a candlestick approaches this line, you can either wait for a pullback to buy or take action immediately.

In the EUR/USD chart, we see a complete Inside Bar pattern formed after the market broke below a crucial support level. This pattern indicates that the price will continue downward to another support level at 1.2625 after reaching a low.

Conclusion

As demonstrated by these three simple price action strategy patterns, trading can be simple, and it can require more cluttering charts with numerous useless technical indicators. Mastering and perfecting a single trading strategy (such as price action trading) can turn you into a professional and profitable trader. Remember, mastering these trading strategies requires passion, effort, and discipline.